How Much Is The Property Tax In South Carolina . Real and personal property are. property tax rates. property tax is administered and collected by local governments, with assistance from the scdor. the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. property taxes in south carolina. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on.

from itep.org

the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. property taxes in south carolina. Real and personal property are. property tax is administered and collected by local governments, with assistance from the scdor. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. property tax rates.

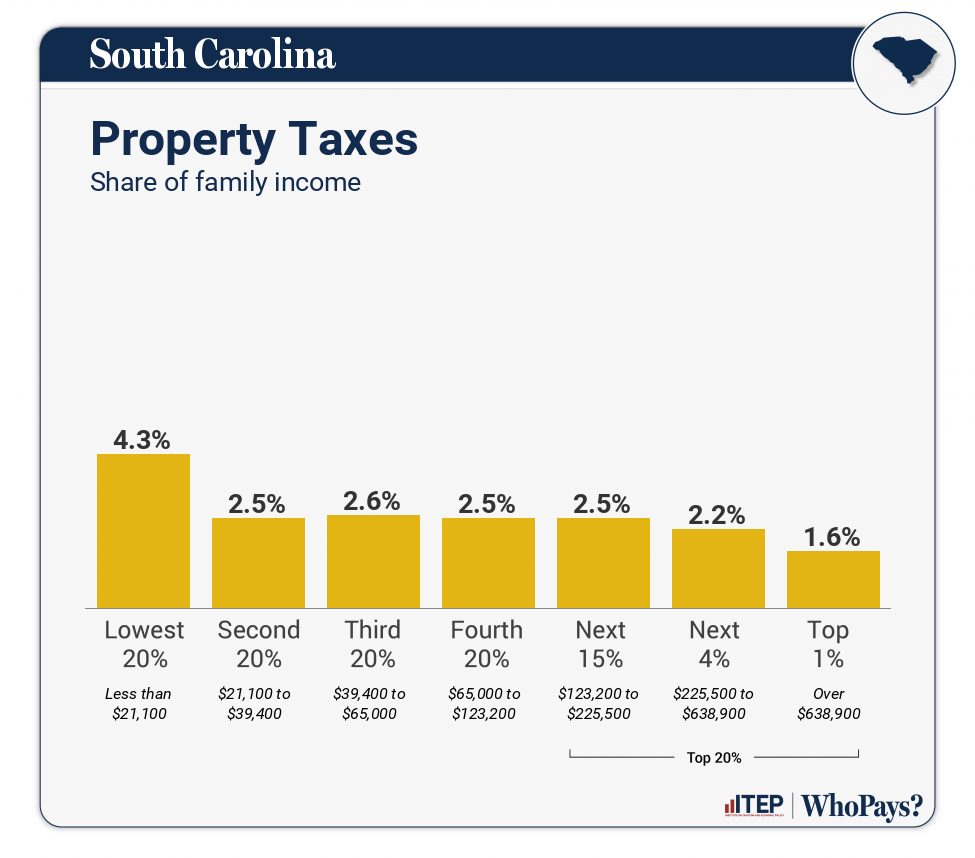

South Carolina Who Pays? 7th Edition ITEP

How Much Is The Property Tax In South Carolina The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. property taxes in south carolina. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. property tax rates. property tax is administered and collected by local governments, with assistance from the scdor. The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. Real and personal property are.

From www.youtube.com

South Carolina Property Tax Rates YouTube How Much Is The Property Tax In South Carolina property tax is administered and collected by local governments, with assistance from the scdor. the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. property taxes in south carolina. calculate how much you'll pay in property taxes on your home, given your location and assessed home. How Much Is The Property Tax In South Carolina.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment How Much Is The Property Tax In South Carolina our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. property tax is administered and collected by local governments, with assistance from the scdor. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. property tax rates. The. How Much Is The Property Tax In South Carolina.

From nikiqnickie.pages.dev

South Carolina Tax Free 2024 Tonye How Much Is The Property Tax In South Carolina The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. property taxes in south carolina. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. property tax rates. the median property tax in south carolina is $689.00 per. How Much Is The Property Tax In South Carolina.

From www.youtube.com

FAQ What are Capital Gains Taxes? South Carolina Real Estate YouTube How Much Is The Property Tax In South Carolina property tax is administered and collected by local governments, with assistance from the scdor. the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. property tax rates.. How Much Is The Property Tax In South Carolina.

From www.pinterest.com

LowestPropertyTaxbyState Property tax, Estate tax, State tax How Much Is The Property Tax In South Carolina the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. property taxes in south carolina. property tax rates. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. The average effective property tax rate in south. How Much Is The Property Tax In South Carolina.

From taxfoundation.org

Property Taxes by State How High Are Property Taxes in Your State? How Much Is The Property Tax In South Carolina property tax rates. The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. Real and personal property are. property tax is administered and collected by local governments, with assistance from the scdor. our south carolina property tax calculator can estimate your property taxes based on similar properties,. How Much Is The Property Tax In South Carolina.

From dailysignal.com

How High Are Property Taxes in Your State? How Much Is The Property Tax In South Carolina our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. property tax rates. property tax is administered and collected by local governments, with assistance from the scdor. the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00. How Much Is The Property Tax In South Carolina.

From itep.org

South Carolina Who Pays? 7th Edition ITEP How Much Is The Property Tax In South Carolina the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. Real and personal property are. the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. property tax rates. property taxes in south carolina. . How Much Is The Property Tax In South Carolina.

From www.youtube.com

How To REALLY Save on South Carolina Property Taxes YouTube How Much Is The Property Tax In South Carolina calculate how much you'll pay in property taxes on your home, given your location and assessed home value. property tax is administered and collected by local governments, with assistance from the scdor. the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. our south carolina property. How Much Is The Property Tax In South Carolina.

From www.crgcompaniesinc.com

Property Taxes South Carolina Ranked 7th Lowest In The Country How Much Is The Property Tax In South Carolina The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and. How Much Is The Property Tax In South Carolina.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills How Much Is The Property Tax In South Carolina The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. property taxes in south carolina. property tax rates. the median property tax in south carolina is $689.00 per year for a home worth the median value of $137,500.00. property tax is administered and collected by local. How Much Is The Property Tax In South Carolina.

From rfa.sc.gov

Property Tax Reports South Carolina Revenue and Fiscal Affairs Office How Much Is The Property Tax In South Carolina property tax rates. Real and personal property are. the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. property taxes in south carolina. The. How Much Is The Property Tax In South Carolina.

From oysterlink.com

South Carolina Paycheck Calculator Calculate Your Net Pay How Much Is The Property Tax In South Carolina property tax rates. The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. Real and personal property are. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. our south carolina property tax calculator can estimate your property taxes. How Much Is The Property Tax In South Carolina.

From taxfoundation.org

To What Extent Does Your State Rely on Property Taxes? Tax Foundation How Much Is The Property Tax In South Carolina the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. property taxes in south carolina. property tax is administered and collected by local governments, with assistance. How Much Is The Property Tax In South Carolina.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics How Much Is The Property Tax In South Carolina property tax is administered and collected by local governments, with assistance from the scdor. property taxes in south carolina. property tax rates. the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. the median property tax in south carolina is $689.00 per year. How Much Is The Property Tax In South Carolina.

From www.msn.com

9 Things To Know About South Carolina's Taxes How Much Is The Property Tax In South Carolina the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. property tax rates. The average effective property tax rate in south carolina is 0.57%, but this can vary quite a bit depending on. property taxes in south carolina. calculate how much you'll pay in. How Much Is The Property Tax In South Carolina.

From www.templateroller.com

Form SC1040X Fill Out, Sign Online and Download Printable PDF, South How Much Is The Property Tax In South Carolina the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. property tax rates. property tax is administered and collected by local governments, with assistance from the scdor. Real and personal property are. the median property tax in south carolina is $689.00 per year for. How Much Is The Property Tax In South Carolina.

From www.ezhomesearch.com

Ultimate Guide to Understanding South Carolina Property Taxes How Much Is The Property Tax In South Carolina property tax rates. property tax is administered and collected by local governments, with assistance from the scdor. the median property tax in south carolina is $689.00 per year, based on a median home value of $137,500.00 and a median. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show. How Much Is The Property Tax In South Carolina.